Learn About Opportunity Zones:

January 30th 5:30 - 7:00 pm @ The Ritz Carlton

An Opportunity Zone is an economically distressed community where new investments, under certain conditions, may be eligible for preferential treatment.

January 30th 5:30 - 7:00 pm @ The Ritz Carlton

An Opportunity Zone is an economically distressed community where new investments, under certain conditions, may be eligible for preferential treatment.

Opportunity Zones were added to the tax code by the Tax Cuts and Jobs Act on December 22, 2017. The first set of Opportunity Zones (OZs) were designated April 9th 2018 across 18 states, with tracts thereafter designated in all 50 states.

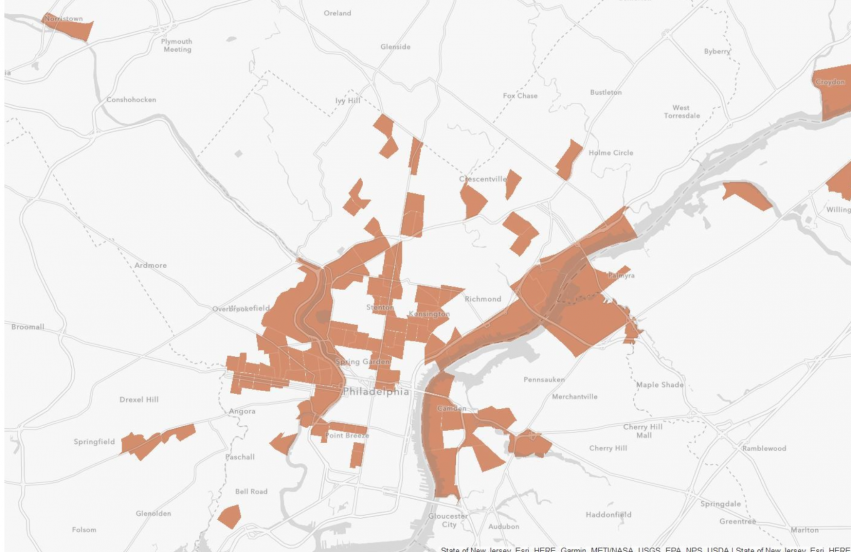

Opportunity Zones are an economic development tool with a focus on spurring economic development and jobs creation in distressed communities. Low income census tracts were nominated and then certified by the U.S. Treasury. Now that Opportunity Zones have been approved partnerships & corporations can invest capital to finance new projects and business enterprises in exchange for certain federal capital gains tax advantages. Philadelphia has been designated with 82 of Pennsylvania's 300 opportunity zones.

To invest in an Opportunity Zone you will have to create a Qualified Opportunity Fund (QOF). A QOF is a partnership/corporation or LLC for investing in eligible property located within a designated Opportunity Zone.

You do not need to live, work, or own a business in an Opportunity Zone to capitalize on the tax benefits. To benefit from an Opportunity Zone you need to invest in a recognized gain and elect to defer the tax on that gain. An example of this would be purchasing land and developing new construction homes to rent and then years from now selling them.

If you're seeking a new investment opportunity real estate development should be a top consideration. It's a great way to diversify your portfolio and new construction projects have huge benefits if you can wait the 10 years to cash in gains tax-free. Benefits of Opportunity Zones include:

Learn from an esteemed tax attorney, and industry professionals in the Philadelphia area. RSVP to register to learn about promising real estate investment opportunities and tax advantages.

We